Here's What You Need To Know About Cryptocurrencies And How To Start Investing In Malaysia

In this IMHO story, you will learn the fundamentals of cryptocurrencies and how you can start investing in them.

If you have been following global finance news, you must have heard about the boom in cryptocurrencies since late last year

The recent bull run on cryptocurrencies started around late October last year when PayPal announced that it would be allowing its US customers to start buying, holding, and selling cryptocurrencies.

On 12 November 2020, PayPal officially rolled out the feature. Within two months, the price of Bitcoin — the cryptocurrency with the largest market capitalisation — increased by about 120%.

During the period, Bitcoin reached its all-time high at USD41,973, or a 157% spike, in a span of less than two months. It offered an opportunity for traders to double their capital easily.

In the same two-month period, the price of Ethereum — the cryptocurrency with the second-largest market capitalisation — increased by 101%. On 20 February, Ethereum hit its all-time high at USD2,042, before dipping 23% to USD1,567 yesterday, 3 March.

The price of Ethereum increased by 101% year-to-date. Within a one-year period, the coin saw a 550% spike in value, while Bitcoin's price increased by about 457%.

Perhaps the most popular and absurd surge this year so far is Dogecoin, which underwent a 780% surge within a matter of hours after Tesla's chief operating officer Elon Musk tweeted about it. But the move is seen as more of a meme since the coin was created as a joke in 2013.

In this IMHO story, I will share with you what are cryptocurrencies, why the prices are on an upward trend, and how to start investing in it

Of course, I will also share the adverse outcomes of investing in cryptocurrencies so that you know it may be not for you.

The story will be broken down into three parts:

- the introduction

- guide to investing in cryptocurrencies

- tips on maintaining your investment

1. Cryptocurrency is the next big thing

The reason I mentioned all that in the opening is not to make you feel left out, but because if you enter the market at the wrong time, your loss could be just as high as other traders' gain. Long-time traders call this group of people fear-of-missing-out (FOMO) retailers.

I mention all that because I believe cryptocurrency is the future, just like how the Internet and social media were the future for people in the late 1990s and early 2000s.

To back my stance, the total market capitalisation of all decentralised finance (DeFi) — the term for all currencies that do not rely on central financial intermediaries — has increased by 906% from USD149 billion to USD1.5 trillion since the Movement Control Order (MCO) started on 18 March 2020. It is not even one full year yet.

Market capitalisation in DeFi refers to the relative size of a cryptocurrency. According to Binance, it is calculated by multiplying the current market price of a particular coin with the total number of coins in circulation.

In other words, the interest in cryptocurrency has grown by almost ten-fold. More people — or more, specifically — more money have gone into cryptocurrencies than ever before.

I believe one day, everyone will be — at the very least — familiar with using cryptocurrency as the new medium of exchange. However, many critics of Bitcoin have said that it will never take off due to the volatility of its price. No one wants to trade using an unstable currency. But there are stable coins out there with prices that are based on fiat currencies.

2. Mass cryptocurrency adoption is likely to come soon

While PayPal's 360 million users might be the catalyst to the current bull run, many other factors contributed to the rally as well.

Here are three other main reasons:

- Hedge fund managers reversed their positions on Bitcoin and started to equate it to 'digital gold'

- Investing in cryptocurrency is a hedge against inflation as the US dollar and other fiat currencies are being printed more to ail the countries' economies amidst the pandemic

- Investors started to see cryptocurrency as a new way to diversify their portfolio

On 8 February, Tesla announced that they will be investing USD1.5 billion worth of its company cash into Bitcoin, surging the cryptocurrency to a new high at about USD47,400 then — or a 20% increase — within half a day.

The electric vehicle company also said that it expects to start accepting Bitcoin as payment for its products soon.

Following the news, Canadian investment bank RBC Capital Markets told Apple to start building a cryptocurrency exchange and introduce it to its 1.5 billion iPhone users.

The analysts in the bank suggested that Apple fund the cryptocurrency exchange building operation by investing in Bitcoin as a start.

Although it is a mere suggestion, it went on to make headlines around the world, fuelling Bitcoin's upward trajectory.

If those are not enough reasons to convince you that cryptocurrency will be mainstream soon, know this: both Mastercard and Visa have announced their plans to enter the cryptocurrency space.

Mastercard will allow users to transact with cryptocurrency later this year, while Visa has partnered with 35 various cryptocurrency platforms and plans to launch a crypto-trading platform soon. Visa boasts 2.5 billion users worldwide.

3. So what is cryptocurrency?

Now that you know the hype surrounding it, it is time to understand the fundamentals of cryptocurrency and blockchain technology.

Bitcoin — the first cryptocurrency — was invented in 2009. It was created out of frustration after the global financial crisis in the late 2000s, reported The New Yorker.

It serves as an online currency that is not controlled by any organisations or governments. It only takes minutes for one transaction to go through, a process that will normally take days if the money has to go across borders.

In other words, I will have no trouble sending money home from whatever country I am in and I do not have to worry about the hefty interbank charges and delays. Its implication is a threat to the banking system.

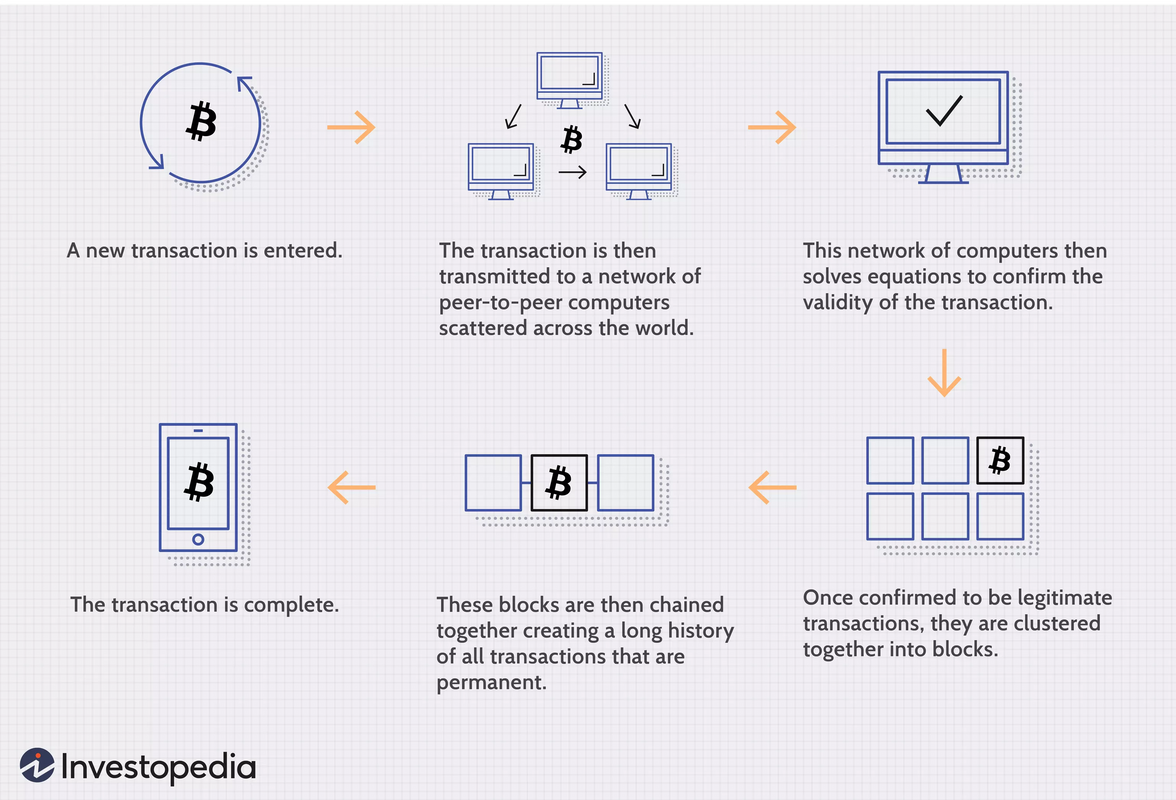

But how does it work? To put it simply, Bitcoin is a peer-to-peer payment system powered by millions of computers that run a software to execute transactions and record them in a public ledger. There are no central intermediaries such as brokerages, exchanges, or banks to interfere with the process.

Every transaction comes in a form of a digital block. After it is filled up with transaction information, it will be clamped onto the previous block, which makes the data chain together in chronological order.

Each Bitcoin is created by 'miners' who use their computers to solve complex mathematical puzzles while verifying transactions and maintaining the public ledger. Only 21 million Bitcoins will ever be created.

It is said that the mathematical puzzles will progressively get more difficult to solve and the last Bitcoin is not expected to be mined until 2140. There is a finite amount of Bitcoin, unlike fiat currency such as the US dollar.

So the digital currency can be seen as a deflationary currency as the prices will only go up, provided that it is always in demand. For this sole reason, Bitcoin has been described as 'digital gold' because just like the precious metal, there is only a finite amount of them on earth. Just last week, Bitcoin hit 10% of gold's total market capitalisation, which valued at about USD10 trillion.

Different cryptocurrencies have different functions. While Bitcoin is seen as a deflationary currency, Ethereum — on the other hand — is prone to inflation. There is no fixed amount of Ethereum in circulation.

Ethereum's specialty is its ability to offer smart contracts, a function that can be seen as a disruption to trillion-dollar industries, such as banks and insurance.

It uses blockchain technology to allow two users to get into a self-enforcing mutual agreement that cannot be inhibited by a third party. This function could easily change how we look at loans in the future. And that it is just one of many use cases of Ethereum.

Many cryptocurrencies go through updates to increase and improve their functions. Furthermore, the reason why one coin is more popular than the other is also because of what it can do or what industries it aims to disrupt. So be sure to study the coins before investing.

4. The danger of investing in cryptocurrencies

Prices of cryptocurrencies are very volatile. 10% to 30% in changes of prices within a day are not unheard of. In fact, it is getting more and more common in this current bull run. Alternative coins (altcoins) — non-Bitcoin cryptocurrencies — are even more prone to volatility due to their relatively smaller market capitalisations.

Another risk in investing in cryptocurrencies is that it trades 24 hours, unlike the stock market that only opens during the day. You could potentially wake up from sleep and see yourself losing a big chunk of your investment.

Next up is unpredictability. The stock market is traded based on the performance of a company, which can be analysed and understood. The same cannot be said for cryptocurrency as it is not a business.

One cannot apply fundamental analysis to study the health of the cryptocurrencies' financial statements, annual reports, or competitors' reviews. The only way is through technical analysis — forecasting the direction of prices through the study of past market data, primarily price fluctuation and volume. The method is speculative because one big news surrounding the coin can invalidate the analysis.

For example, on 11 January, Britain's Financial Conduct Authority put out a stark statement warning investors to be prepared to lose their money in cryptocurrency. The statement alone wiped out USD200 billion from the total value of all cryptocurrencies combined. Bitcoin's price plunged over 20% following the news.

Another example is the rumour of Bitcoin 'double-spending'. Double-spending refers to a potential flaw in cryptocurrency systems where the same batch of coins is used twice while tampering with the public ledger in the blockchain. In the end, double-spending in Bitcoin never happened, but the news alone pulled its price down by over 20% from around USD36,000 to USD29,400.

Earlier this week, Bitcoin and Ethereum underwent a 'price correction' and shredded about 20% of both prices.

There are cases where cryptocurrency exchanges were hacked as well. A human error of keying the wrong address (equivalent to a bank account number) while transferring coins could make your coins disappear forever too as transactions are not reversible in the blockchain.

5. Understanding different exchanges available

There are only three cryptocurrency exchanges recognised by the Securities Commission (SC) Malaysia.

They are:

- SINEGY

- Tokenize Technology

- Luno

Only the latter two allow users to trade other than Bitcoin and Ethereum.

Luno is the most popular exchange in Malaysia. It has about six million users from 40 different countries. They have offices in the UK, South Africa, Australia, Singapore, Malaysia, and more.

As for international exchanges, you can try Binance and eToro, among others. Different platforms have different trading fees, but the ones I have mentioned here have relatively lower fees compared to other platforms.

International exchanges have more altcoins for you to choose from as well.

6. Here's how you can start trading

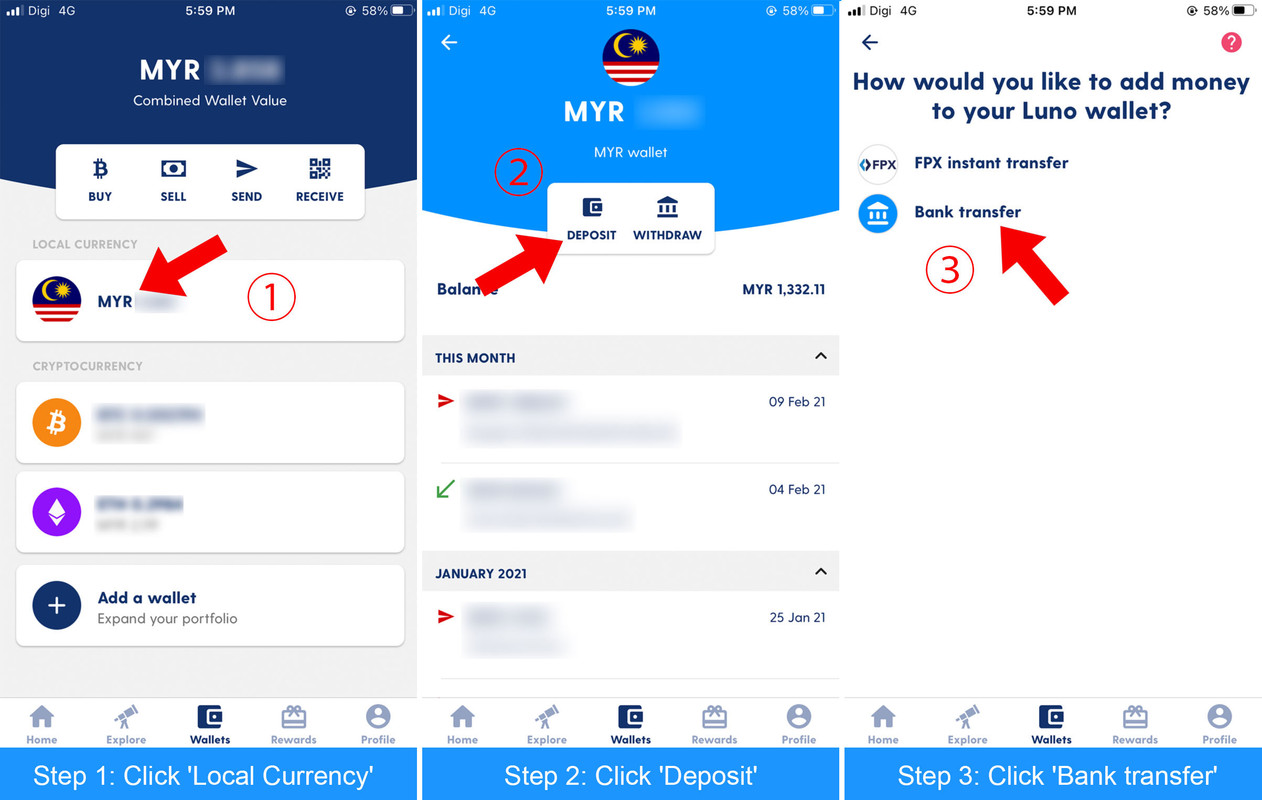

In this section, I will show you how you can start trading on Luno. It accepts deposits from local banks easily.

It is also a great cryptocurrency wallet to have as it can be a bridge for you to trade on other international exchanges by transferring coins from Luno wallet.

Signing up an account on Luno is pretty straight forward. You will have to authenticate your identity by submitting photos of your identification card and a selfie.

The account creation process will take you one to two days before you can finally start trading. So if you want to start trading immediately because Bitcoin is rallying at the moment you are reading this, I am sorry. You will have to wait.

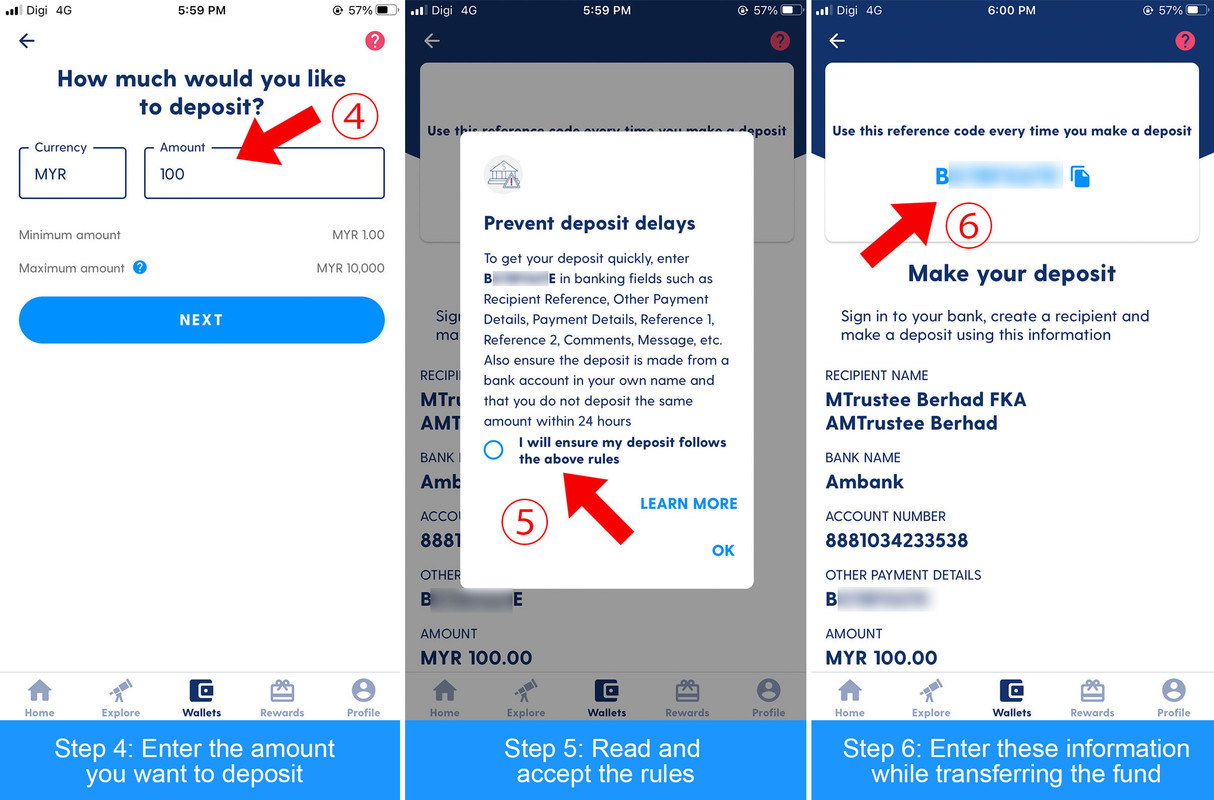

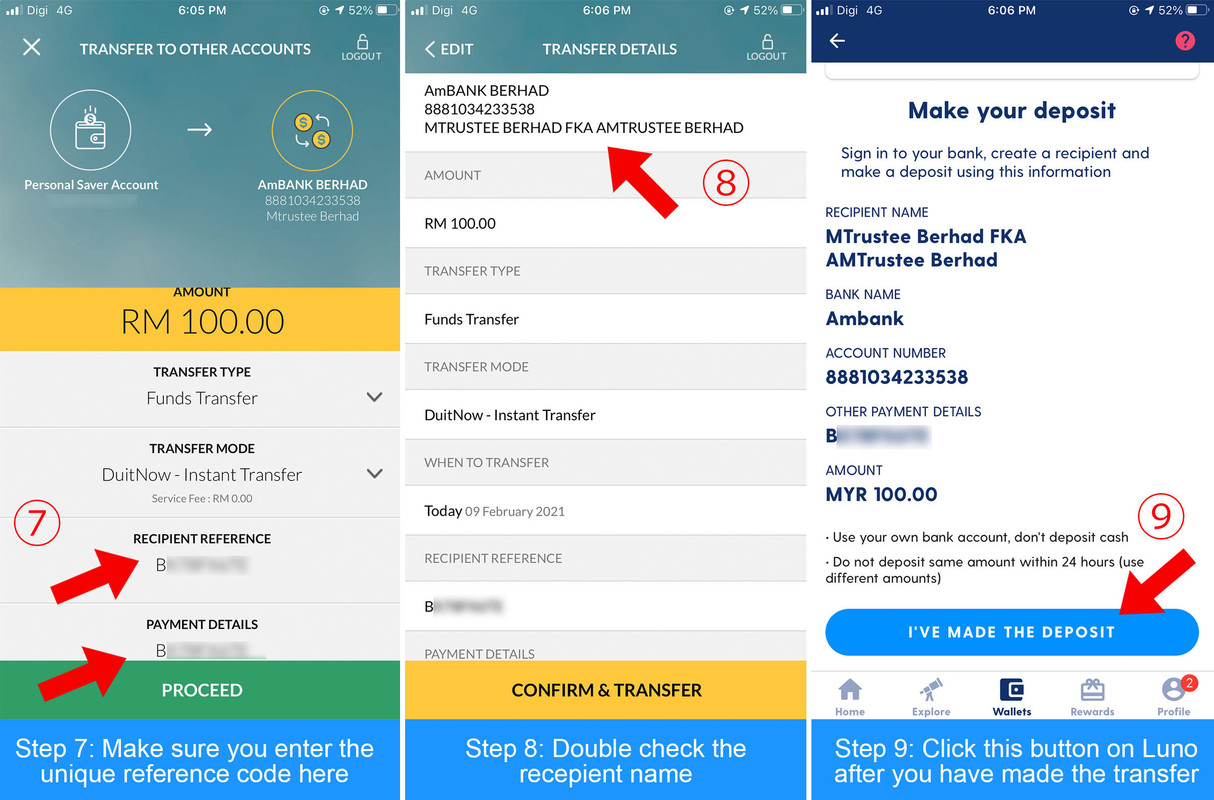

After your account is ready, you can start depositing money into Luno. Below is the step by step guide to making a deposit into Luno:

Make sure you fill in the unique reference code in the recipient reference/payment details section while you are making the transfer. After you are done, go back to Luno to click the 'I've made the deposit' button.

You are advised to use your own bank account to make the transfer and do not make cash deposits. You also must not transfer the same amount within 24 hours.

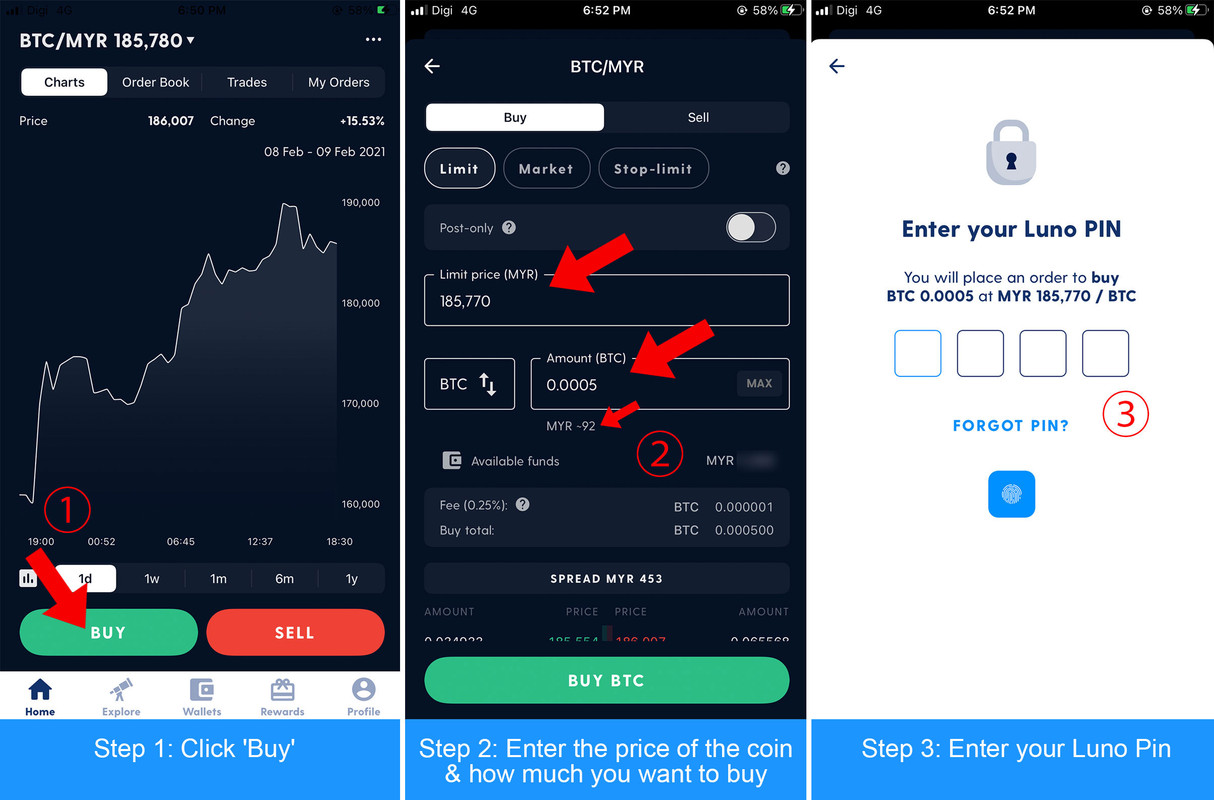

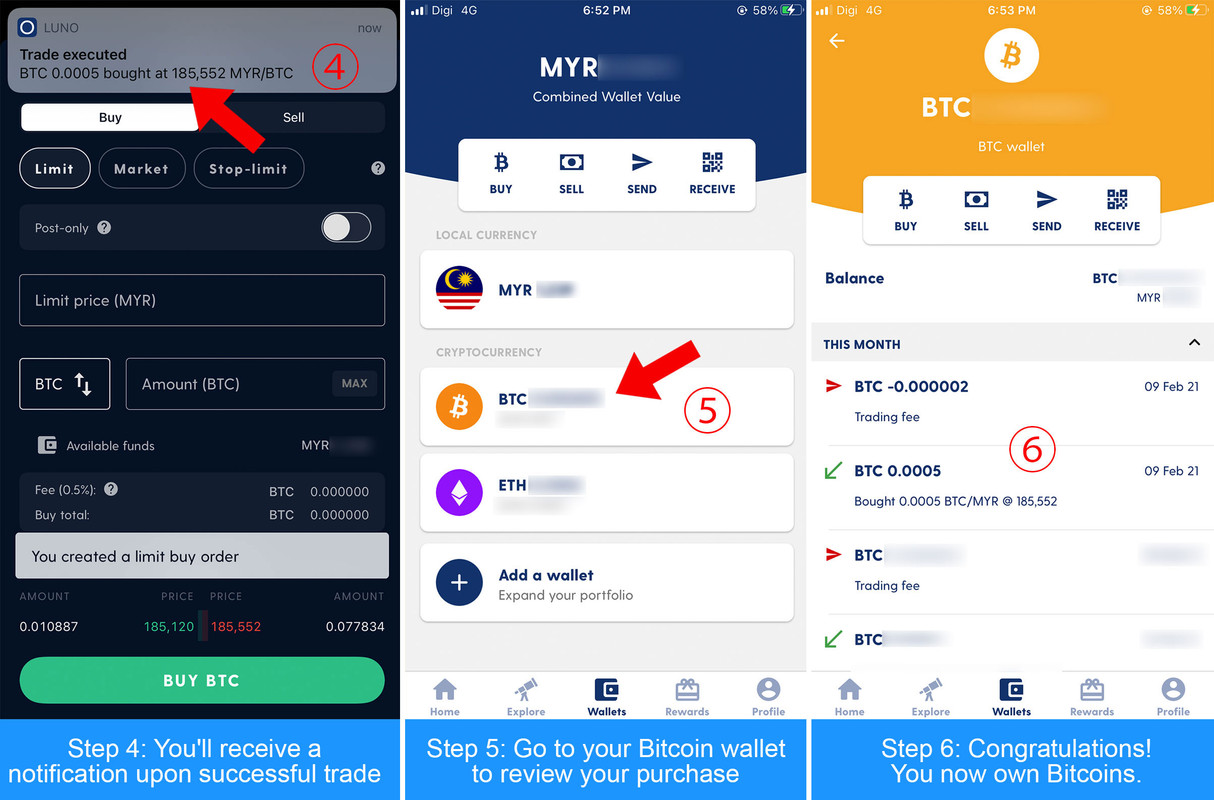

Now, here is how you can start buying Bitcoin, Ethereum, Litecoin, or Ripple:

You can make your home screen feature a more comprehensive price chart by clicking the triple-dot icon on the top right corner and choose 'Exchange'. You will also see the price of the coin in USD there.

It is advised to always include a slightly higher or lower limit price when buying a coin, depending on whether the price is trending upwards or downwards at that moment.

The minimum Bitcoin you can purchase on Luno is BTC0.0005. Notice how much that is in ringgit right below the amount fill.

Sometimes, your trade will not be successful because the price changes too drastically and you miss the price you wanted to buy. To resolve that, go to your 'Wallets' to cancel that transaction and try it again.

To sell a coin, the process is just the reverse of buying a coin.

If you want to learn more, do study up what is the difference between a limit, market, and stop-limit buy and sell.

7. If you are starting out, invest only the money you are willing to lose

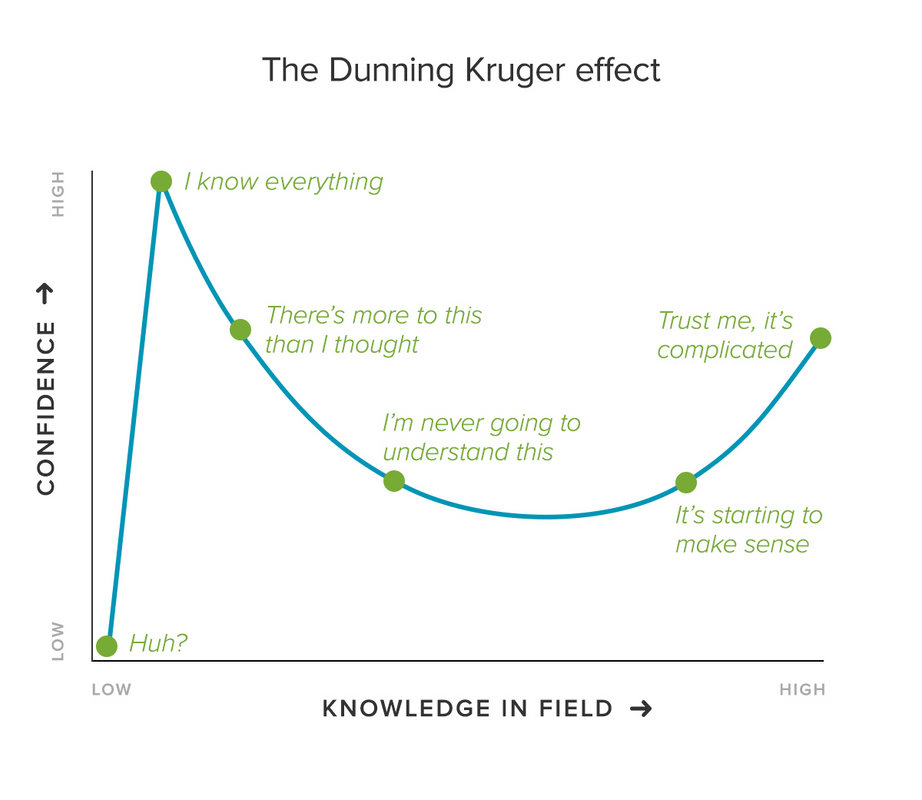

The Dunning-Kruger effect is a terrifying enemy to a beginner trader, especially to those who immediately make money from cryptocurrency investments. The euphoria of making 20% of their capital gain within a short amount of time could be detrimental to the soundness of a new trader's mindset. They might think this trend will continue indefinitely, causing them to take little precautionary measures.

Without understanding the market, your investment could deplete if you panic when the price starts to drop a little or not panic at all when the price starts plunging.

Remember, the prices of cryptocurrencies are very volatile. Being an informed trader is very important. Following global finance news, watching YouTube explainer videos, learning how to do technical analysis, and understanding your risk appetite, among other things, are crucial to becoming a successful trader.

Investing is not about making money, but making the right decisions. Only after understanding the market well enough that you can make sound decisions and consistent returns. Therefore, if you doubt your ability to make a sound decision, don't invest more than you are willing to lose.

Treat this as a learning process. After all, the skills you learn from investing are life-long knowledge you can use to grow your wealth.

8. Tools you will need

To consistently make sound investments as a beginner, you will need the right tools.

Other than reading every piece of news concerning the coins you invested, you will need a tracker to monitor the price movements.

TradingView is an excellent free programme, where you can set up complicated charts as well as simplify them to show only metrics you can comprehend.

For starters, other than knowing the basic navigation, you should get familiar with the 'price range' or 'measure' tool. These tools help you calculate and visualise how much profit or loss you have made.

You should also learn how to add the coins you have invested into the watchlist and create a price alert. The good thing about the programme is that it covers most stock exchanges around the world besides cryptocurrencies.

There are hundreds of tutorials online on how to use TradingView. It is a good idea to get familiarised with it.

Other than that, you will also need tools to study the data of the coins you invested.

CoinMarketCap, CoinGecko, CoinDesk, and messari.io are cryptocurrency sites that house all data pertinent to the coins, such as their market capitalisations, trading volumes and transaction counts within the last 24 hours, and more.

The sites also offer a brief introduction to each coin and some even include the latest news reports about the coins at the bottom of the page.

9. Follow trusted cryptocurrency traders on YouTube, Twitter, and blogs

Other than following cryptocurrency news religiously, it is also great to follow a few cryptocurrency traders or analysts on their social media.

If you are a beginner, YouTube is a great place to start as the visual cues and simpler language can help accelerate your understanding of cryptocurrency investment.

On the other hand, learning how to do technical analysis can also be extremely helpful in your investment journey. Picking up a book on this topic is a great idea.

10. Have a support system

As a beginner trader, you are bound to make mistakes. If you follow what is mentioned in number 7, your losses would not be severe and I bet you would feel glad that you made these mistakes while you are young.

With that said, it is a good idea to have a support system while investing in cryptocurrency. Form a group chat with a few of your friends and keep each other in check. Share valuable content and exchange thoughts and news with one another.

This article is meant to encourage more young people to start investing. If done right, investing may not be as risky as you think.

Compounding returns is a powerful vehicle to make anyone retire early or live a more comfortable life.

If you invest RM400 a month and make a return of 8% a year, the total value of your investment will balloon to RM600,518 after 30 years out of your RM144,400 capital. That is a 415% growth.

If you believe that cryptocurrency is the future, you better put some money into it.

As they say, "Never let a good crisis go to waste." The COVID-19 pandemic is a great opportunity to start learning investing when the stock markets and cryptocurrencies are bullish.

This story is a personal opinion of the writer and does not necessarily reflect the position of SAYS.

You too can submit a story as a SAYS reader by emailing us at [email protected].